The fiduciary, who may be an individual or an institution, is legally obligated to act in the best interest of the beneficiary. Accounting is a back-office function where employees may not directly interface with customers, product developers, or manufacturing. However, accounting plays a key role in the strategic planning, growth, and compliance requirements of a company. In most other countries, a set of standards two types of accounting governed by the International Accounting Standards Board named the International Financial Reporting Standards (IFRS) is used. As a result, all professional accounting designations are the culmination of years of study and rigorous examinations combined with a minimum number of years of practical accounting experience. Financial accounting is performed with potential lenders and investors in mind, as well as GAAP.

What Are Accounting Standards?

They provide everything from consulting and tax advisory to assurance services such as auditing, catering to the unique needs of different clients. Auditing is one of their key offerings, involving the independent examination of financial records to ensure accuracy and compliance with regulatory standards. Cash accounting is a straightforward diary of financial transactions, marking entries only when money changes hands.

Careers and salaries

It’s not only important for businesses in terms of record keeping and general business management, but also for legal reasons and tax purposes. Though many businesses leave their accounting to the pros, it’s wise to understand the basics of accounting if you’re running a business. To help, we’ll detail everything you need to know about the basics of accounting.

How do you become an accountant?

Whether you’re looking to hire accountants or give them more tools, accounting software can help. These tools speed up report generation, tax filing, and payment management. With this software handling rote work, accountants can focus on their most important tasks. While many large businesses hire full-time tax accountants, small businesses don’t have to.

- Using this standard accounting method helps investors and lenders get an accurate read on a business’s financial health.

- Our Financial Close Module is designed to create detailed month-end close plans with specific close tasks that can be assigned to various accounting professionals, reducing the month-end close time by 30%.

- It’s most commonly done by financial accountants to ensure that the company’s financial statements comply with the Generally Accepted Accounting Principles (GAAP) standards.

- The following sections expand on these accounting methods and outline the types of businesses best suited to each one.

- The IRS requires that businesses use one accounting system and stick to it (see below for an exception).

These are the two main types of accounting methods, although sometimes companies are allowed to use a hybrid of the two, if certain conditions are met. Accrual accounting is the go-to method for businesses ranging from e-commerce to manufacturing. Moreover, accrual accounting is legally required for companies that generate more than $25 million in annual sales.

This is the appointing of a custodian of a business’s assets during events such as bankruptcy. Public companies have to follow a set of rules set out by the government (this is the Securities and Exchange Commission in the U.S.). It is also a well-paid profession, with the potential to earn a high salary. This type of accounting career path can be challenging and interesting, which can provide you with a great deal of intellectual stimulation. The work of a forensic accountant is interesting and challenging, and it can make a difference in the world.

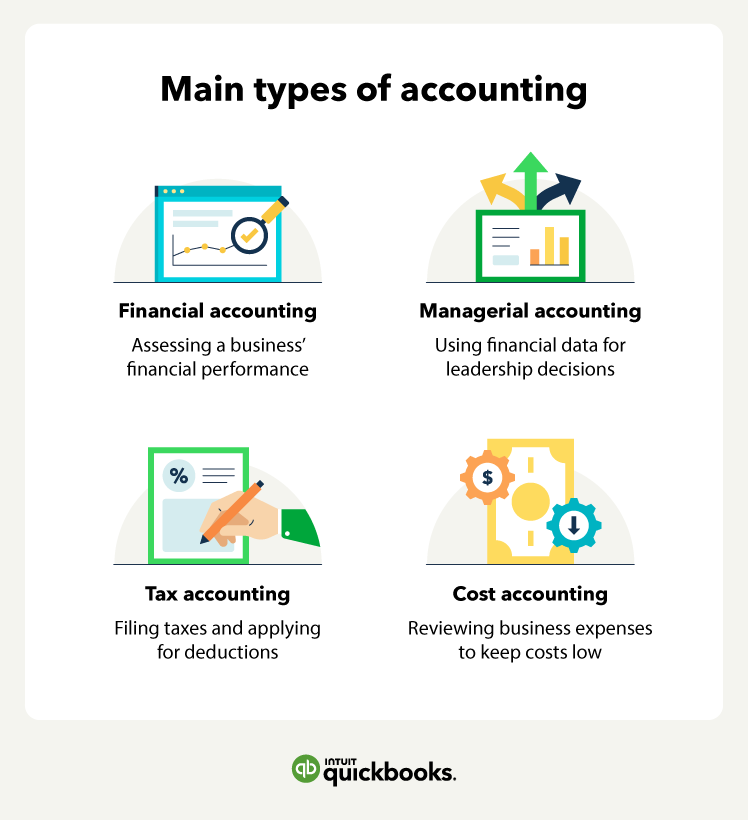

All financial statements, such as a balance sheet and an income statement, must be prepared in a certain way. This tends to be according to the generally accepted accounting principles. This focuses on the use and interpretation of financial information to make sound business decisions. It’s similar to financial accounting, but this time, it’s reserved for internal use, and financial statements are made more frequently to evaluate and interpret financial performance.

Usually issued on a monthly, quarterly, or annual basis, the income statement lists the revenue, expenses, and net income of a company for a given period. Financial accounting guidance dictates how a company recognizes revenue, records expenses, and classifies types of expenses. In accrual accounting, revenue is recorded when it’s earned, not when money actually comes in. Even if the client hasn’t paid yet, revenue is still recorded in the books. The focus here is on generating financial statements like budgets, and product costings.